Complete Loan Origination

and Servicing Software

for Private Lenders

We automate your lending processes

so you can focus on growth.

Complete Loan Origination

and Servicing Software

for Private Lenders

We automate your lending processes so you can focus on growth.

Key Features

Loan Origination

A convenient document uploading module makes it easy to request and sort documents required to satisfy your conditions.

Loan Servicing

Investor Relations

Accounting & Reporting

Industry Award Winner

Key Features

Borrower Portal

The Borrower Portal or a form on your website can be used to submit applications directly into your Mortgage Automator account. Borrowers can review their existing and past loans, see annual statements, request additional funds, and much more.

Everything is white-labeled, making your website the only point of entry needed.

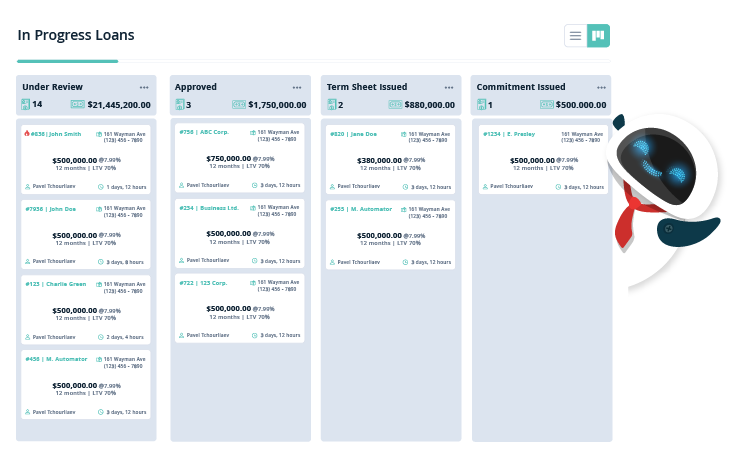

Loan Origination

A complete loan origination suite is available to track the deals in your lending process. Custom processes can be created with loan statuses, user assignments, and individualized tasks to ensure no deal falls through the cracks.

Every possible type of loan is supported, and loan documents (like term sheets) are created automatically to be perfect every time.

A convenient document uploading module makes it easy to request and sort documents required to satisfy your conditions.

Loan Servicing

Powerful features are available for all your loan servicing needs. ACH/PAD payments are completed in seconds; borrowers receive text messages in case of NSFs, even before you get a chance to send them an automatically generated NSF letter; investors can be replaced mid-deal, and much more.

With all the calculations done for you, it’s easy to see why so many companies have adopted Mortgage Automator as the platform of choice.

Investor Relations

A beautiful, organized, and easy-to-follow investor statement is sent automatically on the morning of your investor payments, establishing a clear understanding of their portfolio and, more importantly, trust in your private lending process.

For those investors who are keener to log in themselves, an investor portal is available.

Accounting & Reporting

Numerous accounting and operational reports are

available to give you a complete overview of your operations. At Mortgage Automator, we try to automate every process and report. Whether it’s compliance or trust reinvestment reports, the system has you covered.

Trust and Operating account ledgers allow you to dive deep and understand every number, while an automatic QuickBooks sync perfectly matches your bank statements, making your monthly bookkeeping a breeze.

Focus on Growth

Cut our manual process over 60%

It is custom tailored for our individual needs not only in front and operations but in back and servicing. This software has allowed us to become paper free. I have sat down and talked to many developers in the space. This was the only company that delivered what it said and has the upmost professional team.

The Future of Mortgage Administration

Very user-friendly. Like their slogan says, “For Lenders by Lenders.” As a lender myself, this is a very natural and intuitive software. You can tell that the software is built by a lender.

Mortgage Automator is a game changer!

There are so many features that are great, but the ability to produce so many of our custom documents so quickly has made us super efficient and lifted our game considerably. We can literally turn around a straightforward application in 10 minutes and have a commitment letter sent out. Instructing our solicitor with a file is ultra easy too, as is producing renewal agreements and discharge/payout statements.

The name speaks for itself… and the people are AWESOME!

Mortgage Automator is so user friendly; not much need for training, it is very intuitive to navigate. They are very helpful and super quick to return a call or email. Producing paperwork for us has become so much easier.

Mortgage Automator… Automates!

The Mortgage Automator Platform is relied on as our core loan management database / software. All major features were considered and work as needed, and some custom features have even been developed and implemented based on our company’s suggestions. This software is easily equivalent to 2-3 (or more) additional staff.

Time to be part of industry leading conversations

Top performers are switching to Mortgage Automator to power their entire private lending business and generate all their documents in minutes. It’s time to get ahead of the curve, gain a competitive advantage, and deliver exceptional value to your brokers, lawyers and investors!

300 + happy clients including:

Award Winning Software

Integrations & Partnerships